The stock market is typically divided into several sectors, each representing a group of companies that operate in a similar industry or have related products and services. The sector analysis is very important for enthusiasts who are interested in investing their money in stocks .It is essential to understand each sectors in stock market ,do your research and invest in right sector. Stocks in the stock market is divided into different sectors depending upon their nature of business. For example healthcare, energy, real estate, etc.

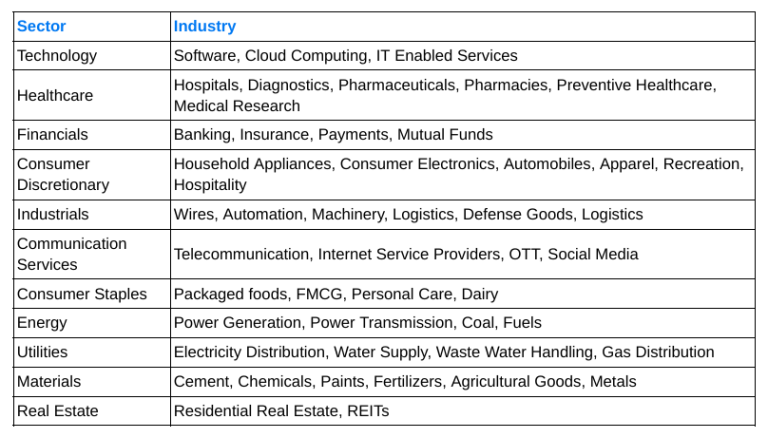

According to Global Industry Classification Standard, or GICS, (which is an industry taxonomy developed in 1999 by MSCI and Standard & Poor’s) there are 11 sectors. The 11 GICS stock market sectors are as follows

1. Healthcare

The health care sectors includes pharmaceutical companies, hospitals, biotechnology companies, medical devices manufactures, health insurance companies.

2. Industrials Sector

Industrial sector includes manufacturing and constructions ,aerospace and defense ,electrical equipment, transportation including cars ,airlines and railways

3. Materials Sector

Material sector includes Metals and mining companies, Paper and glass making companies , manufactures of construction materials and chemicals.

4. Utilities Sector

The utilities sector includes companies such as electric, gas, or water utilities, or those that operate as producers or distributors of power. This sector requires expensive infrastructure that needs regular upgrades and maintenance.

5.Energy Sector

This sector includes oil and natural gas companies. That means companies engaged in the exploration, production and marketing of oil and natural gas .This includes pipeline, refinery and coal mining companies .

6 Technology Sector

Technology sector includes industries from semi-conductor chip producers , software and hardware providers, internet stocks ,mobile phone makers and cloud computing.

7 Financial Sector

The financial sector consists of many different industries ranging from banks, investment houses, insurance firms, real estate brokers, consumer finance firms, mortgage lenders, and real estate investment trusts (REITs).Banks include

- Public banks

- Commercial banks

- Central banks

- Cooperative banks

- State-managed cooperative banks

- State-managed land development banks

Non-banking financial institutions are financial institutions include

- Finance and loan companies

- Insurance companies

- Mutual funds

- Commodity traders

8 Communication Services Sector

The Communication Services sector includes telecommunication services (diversified and wireless) and media and entertainment companies , interactive media and services.

9 Real estate Sector

Real estate stocks are companies that own or operate real property. It generally includes two different types of investments related to real estate. First category include companies developing new real estate projects or managing them. Second category includes real estate investment trusts (REITs), a special category of public companies that own real estate.

10 Consumer staples sector

This sector includes companies making food items ,beverages and tobacco products, The producers of household goods and personal products are also included in this sector .Along with that companies that specialize in selling staples, such as supermarkets, also included. Consumer staples is considered to be a defensive sector because irrespective of all economic condition ,people depend on these sector for their daily needs.

11 Consumer discretionary sector

This sector includes companies that produce and sell non-essential goods and services. Companies that manufacture products and provide services that consumers purchase on a discretionary basis. Cars, household appliances, specialty items, luxury, and leisure are all considered part of the consumer discretionary sector.

Best Consumer discretionary stocks

Sector analysis helps an investor to identify how well companies in each sector are performing. We can easily identify most promising sector and put money in one or two good stocks in that sector .Investors can also shift their investments from one sector to another, depending upon the market conditions. This is called sector rotation.

After identifying a sector, collect information pertaining to that sector like earnings report ,take an in-depth look at interest rates, inflation, GDP growth and the government policies that affect that sector . And at last read up on the recent developments and innovations in that sector. These inputs should help you understand and analyze the sector correctly. Based on your analysis, develop an investment strategy that aligns with your risk tolerance, investment goals, and time horizon. It’s essential to combine sector analysis with individual company analysis and a broader understanding of market trends to make well-informed investment decisions.